Do More with Digital Banking

Accounts

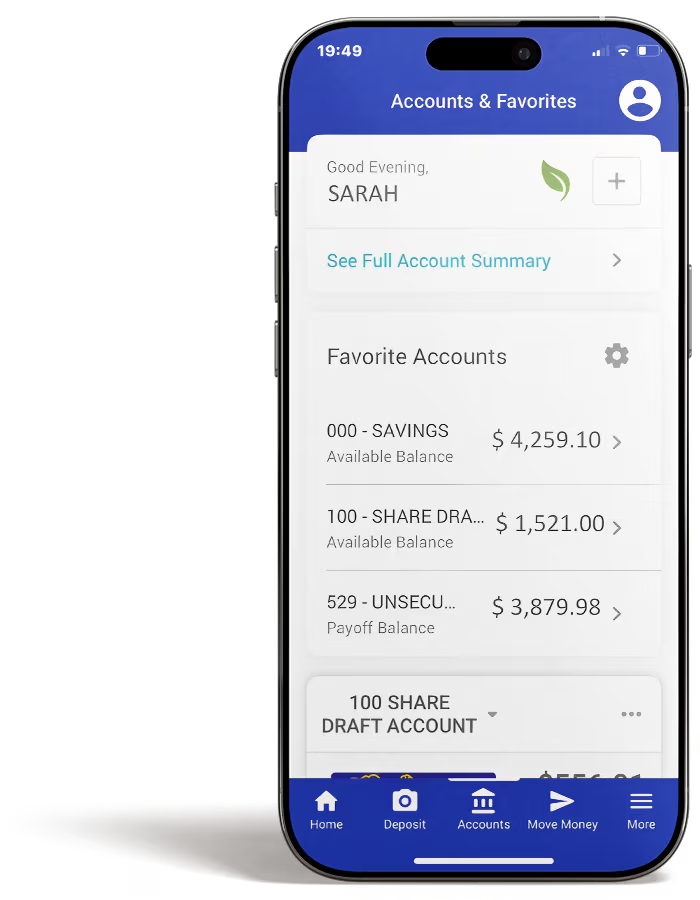

- See real-time balances and recent activity

- View and download eStatements

- Update contact information

Account to Account (A2A) Transfers

- Move money between STTFCU accounts

- Schedule one-time or recurring transfers

Loans

- Apply for a loan online

- Make loan payments

- Check current loan rates

Checks

- Deposit checks with your phone (mobile deposit)

- Order new checks

- Place a stop payment

Cards & ATMs

- View card activity and balances

- Report a card lost/stolen

- Find surcharge-free ATMs

Alerts & Security

- Set up account and balance alerts (email/text)

- Time-out protection and secure login

- Industry-standard encryption

Text Banking & CU*Talk

- Get balances and recent history by text

- Use telephone banking (CU*Talk) when Wi-Fi is limited

Help & Support

- Contact our team (Message and data rates may apply. Features may vary by device.)

Download Our Mobile App Today!

Top 5 reasons to use the STTFCU mobile app:

-

1

It’s safe by design Secure login, timed logouts and encryption protect your info. -

2

Anytime balance & history Know what’s in your account before you spend. -

3

Deposit checks in minutes Snap, submit, done. Save a trip to the branch! -

4

Pay your way Transfer between accounts and pay bills on your schedule. -

5

Stay in the loop Turn on alerts so you always know what’s happening with your money.